Market anticipates higher earnings trajectory until year-end (2012 Year-end Target: 1,670 points)

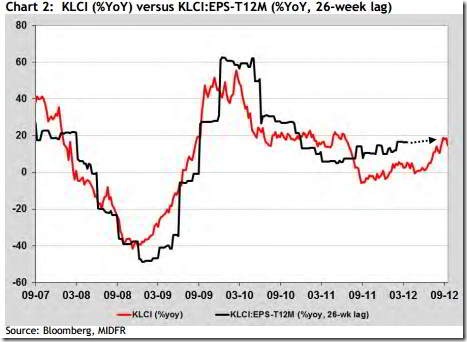

Based on empirical observations, the movement of FBM KLCI is a good leading indicator to its upcoming earnings result performance. Our ‘best-fit’ historical chart of the FBM KLCI against its 12-month trailing earnings (KLCI:EPS-T12M) shows the latter lagged the former by about 26 weeks . The approximately half-year lead time is adequate to provide reliable guidance on earnings performances of the recent/prevailing as well as subsequent quarters.

• Market priced-in higher earnings until at least up to 4Q12

• It also expects 2012 on-year earnings growth in the mid to high-teens

• We reiterate our FBM KLCI 2012 year-end target of 1,670 points

Market priced-in higher earnings at least up to year-end.By looking at the performance of FBM KLCI during the past 26 weeks (see Chart 1), we can expect its trailing earnings to at least sustain its ground in the third quarter and to continue on an upward momentum in the subsequent quarter ending December 2012.

Failure of earnings to perform to market expectation shall invite price correction.Nonetheless, as evident during the period of between 4Q10 to 2Q11, failure of earnings to keep pace with market expectation may sooner or later results in price correction.

But expect 2H12 earnings to meet market expectation.Our economist recently upped our 2012 GDP target for Malaysia to 5.3% (from 4.8%). Furthermore, the economy is expected to grow 5.3% in the current half against 5.2% recorded in 1H12. Hence we see a low chance for corporate earnings in 2H12 to lag the performance of the preceding half.

On-year earnings growth to remain firm in coming quarters.In tandem with the firming year-on-year growth performance of FBM KLCI during the past 26 weeks (see Chart 2), we can expect its trailing earnings growth to also remain firm in 3Q12 and to trend steadily higher in the succeeding quarter. The on-year earnings growth is expected to be in the mid to high-teens, which is in congruence with ours and consensus expectations.

Reiterate FBM KLCI year-end 2012 target of 1,670 points.Both ours and consensus FBM KLCI earnings growth for this year are expected to be in the mid to high teens, i.e. 16.6% and 18.9% respectively. The numbers are supported by (i) organic earnings growth performance, as well as (ii) absence of lumpy abnormal losses. We reiterate our FBM KLCI 2012 year-end target of 1,670 points (PER of 15.4x CY2012 earnings). Likewise, we retain our FBM KLCI 2013 year-end target of 1,750 points (PER of 14.7x CY2013 earnings).

by MIDF