After a brilliant 2013, the FBM KLCI may underperform its peers in 2014

Reversion to mean valuation. In our Strategy note dated 8 January, we highlighted that the comparative valuation of the FBM KLCI surpassed all its regional peers and “the glaring disconnect between the valuation of the local benchmark vis-à-vis its regional counterparts leads us to believe that, going forward, there is a greater tendency for the FBM KLCI to revert back towards its mean PER, rather than otherwise.”

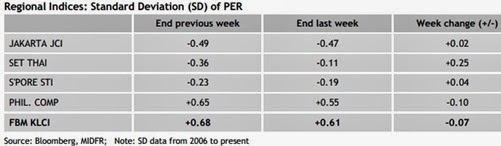

…has arguably beginning to take hold. Based on latest weekly data, the mean reversion tendency has in fact beginning to take hold as the market valuation of regional indices is already showing an early sign of normalizing. From the Table above, it is rather apparent that equity benchmarks which were trading at levels below their longterm mean PER, i.e. SD of less than zero, recorded week-on-week expansions with regard to their current year PER valuation. On the other hand, equity indices which were trading at a premium valuation to its secular average showed week-on-week shrinkages.

Fundamentally, FBM KLCI valuation may be capped by liquidity, earnings and monetary factors. We reiterate our view that, going forward, the FBM KLCI above-mean current year PER valuation may be capped by the following possible headwinds: (i)measured albeit incessant withdrawal of foreign liquidity pursuant to the commencement of QE3 taper, (ii) relatively muted FBM KLCI earnings growth of circa 10% in 2014, (iii) expectation of a hike in the OPR, as well as (iv)Malaysia’s relatively weak albeit improving current account situation.

After a brilliant 2013, the FBM KLCI may underperform its peers in 2014. The reversions to mean valuation, ceteris paribus (i.e. no concomitant change in earnings), have a direct bearing on the price performance of the respective indices. Therefore, without favourable earnings revision, the FBM KLCI which commanded the richestrelative current year PER valuation among its peers was also the hardest hit so far this year at -2.30%.

Reiterate FBM KLCI 2014 year-end target of 1,900 points. Hence, our rather modest FBM KLCI baseline 2014 yearend target of 1,900 points

by MIDF