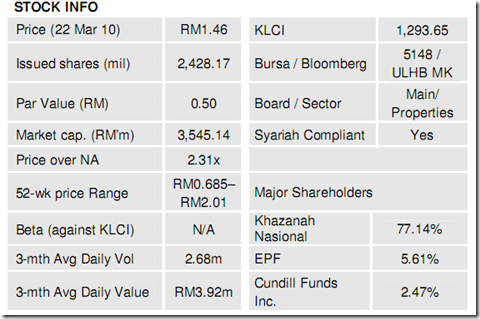

UEM Land Bhd 1-for-2 Rights.

• UEM Land Bhd (ULHB) has proposed a 1-for-2 rights issue priced at RM0.80 per share to raise RM971.3m. A total of 1214.1m shares will be offered to existing shareholders. 77.14% will be subscribed by the UEM Group.

• The issue price of RM0.80 per rights share is a 44.1% discount to the counter’s 5-day moving average (RM1.43) and -34.4% to the derived theoretical ex-rights price of RM1.24.

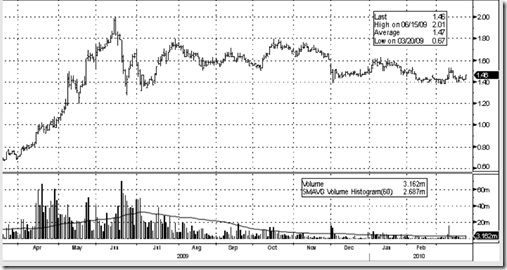

• Maintain NEUTRAL with revised Target Price of RM1.25 ex-rights, derived from a 25% discount to RNAV. We advise existing shareholders to subscribe to the rights share to further increase their investment and equity participation. Despite our ex-price TP providing a mere +2.4% upside to the counter, the subscription of the rights is a viable option for investor to average down cost. Note the ULHB traded at its highest at RM2.01 per share on 15th June 09.

Purpose of proceeds. The group had proposed 5 utilizations for the proposed rights issue:-

i) Repayment of a Term Loans (RM633.0m) owed by Bandar Nusajaya Development Sdn Bhd to UEM Group.

ii) 1st installment for the purchase of land parcels in Cyberjaya for its Symphony Hills development (RM65.1m)

iii) Working capital and property development expenditure of ULHB Group of companies (RM266.2m) and

iv) Estimated expenses related to the proposed rights issues (RM5.7)

Balance sheet strengthened. We view the proposed rights issue as vital for ULHB to stay afloat. Note that a major portion of the proposed proceeds (65%) will be used to pare down debts. Hence, we expect balance sheet to be strengthened post-rights and provide room for gearing in future, as ULHB accelerates further developments in Nusajaya. Assuming the rights are fully-subscribed, gearing levels are expected to reduce to 0.05x (previously 0.48x).

Timely but vital for future growth. In our previous discussion with management, they indicated that forthcoming developments will be driven by ULHB’s initiatives, as part of the group’s long-term goal to achieve its ‘tipping point” in 2012. This was mainly supported by the fact that the economic corridor was starved of FDIs in 2009. We view the funds raised to be an impetus towards the long-term growth of the economic corridor. Moreover, the clean-up of its

books will allow ULHB to start anew and gear-up for future developments with variable financing options.

Earnings dilution effect on EPS 10/11. Post-rights, EPS 10/11 will be diluted by -33%. Despite the earnings dilution, we maintain our FY10/11 forecasts as we prefer to await stronger evidence of developments, given the lackluster pace in 2009. We reiterate our view that future earnings will continue to be supported by strategic land sales with the group’s landbank balance of about 9,000 acres. Land demand in Nusajaya will stride with the global economy recovery and improving domestic property market.

Reiterate NEUTRAL. Our Target Price is derived from a 75% discount to RNAV. The steep discount is based on high execution risk in relation to the completion of the economic corridor within the stipulated timeframe and the concentration risk of the land bank in a single geographical area remains significant.

source: MIDF Research