MALAYSIA EQUITY MARKET FOREIGN FLOW

-

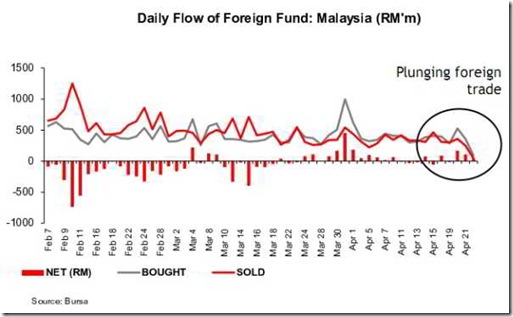

In the local market, foreign investors turned net buyers after the selling last week.

-

Based on Bursa's data until Thursday, foreign investors bought RM396.1m net last week, which was relatively aggressive. It was the second highest net add number since January. Gross purchase amounted to RM1.7b for the week, less than the RM1.8b recorded in the week before. Daily foreign gross trade (purchases + sales) stayed below RM1b indicating that interests in Malaysian stocks was still in the lower gears.

-

Foreigners were consistent net buyer last week, selling only on Tuesday. But foreign interest in the local stocks plunged dramatically on Friday. On Friday, gross purchase amounted to only RM90.3m while gross sale was RM43.9m. The gross trade on Friday was therefore only RM134.2m, the LOWEST daily trade this year.

-

Local institutions continued to be net sellers last week as they unloaded about RM3.9b worth of stocks. Retail investors continued to be net buyer for the third consecutive weeks, the longest buying streak since early February. However, volume declined as momentum was receding.

MALAYSIA EQUITY MARKET: WEEK AHEAD

-

If not for the dramatic plunge in foreign trade on Friday, we would have donned a bulls hat outright this week.

-

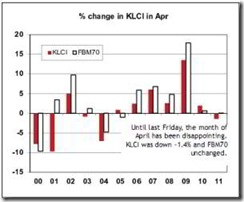

As of last Friday, April had been disappointing. The FBM KLCI is down -1.4% for the month while the FBM70 is unchanged. However, we are still expecting April to close in the positive territory. The FBM KLCI needs to recover 22.4 points in 5 trading days just to break even this month. If the index fell short this month, it would have broken the record of 6 consecutive years in which April had closed in the positive territory.

-

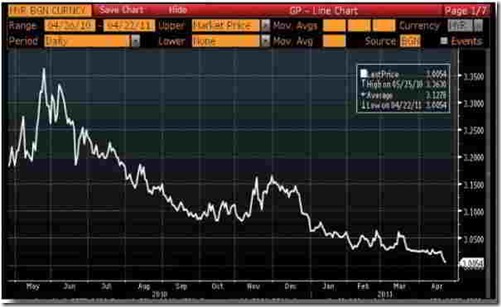

However, we are upbeat that the index will close this month on a positive note.The dollar is under heavy pressure currently and is just hovering above RM3.00 against the ringgit last Friday. A weakening dollar is a strong reason for global funds to stay put in Asia. While there will ultimately be a withdrawal of foreign funds from this region, creating a hollowing out effect on equity prices, we do not this to happen in the next few months, certainly not this week. Therefore the downside for the market is constricted.

-

We believe that if not for the central banks intervention, the ringgit would have crossed the RM3.0 mark last week. The central bank prefers the ringgit to move according to its fundamentals and will move in to neutralize any demand imbalances arising from the movement of short-term external capital. If the ringgit broke the RM3-mark against the greenback, it will be the ! first time the threshold is broken since the 1997/98 Asian Financial Crisis. We expect the ringgit to hit 1USD/RM2.95 this year

by MIDF