Malaysia Inflation Rose To The Fastest Pace.

Inflation is still a major concern and we expect the upward pressure to stay in 3Q2011 coming from food & non-alcoholic and clothing/footwear in view of the festive seasons. Impact from June’s electricity tariff hike is expected to continue. But the upward inflation pressure can be contained from stronger RM/USD and high base comparison. Nonetheless, we expect inflation to start easing by end 3Q2011 or early 4Q2011. Meanwhile, with global uncertainties flared by euro debt crisis and slower US economic recovery lingering, it has forced AxJ policymakers to focus on growth as opposed to inflation. Rates hikes could be reaching its tail end. We expect BNM to accommodate further erosion in real returns by holding OPR at 3.00% to focus on growth. But possibilities for another 25bps hike in OPR remains, as it depends on inflation outlook. Likewise SRR hike will depend on liquidity inflow. If that happen, we expect another 50bps to 100bps hike.

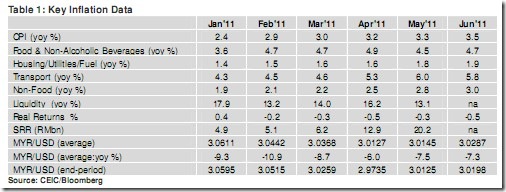

• Malaysia Inflation rose to the fastest pace: Inflation in June rose at the fastest pace since March 2009. Inflation was up 3.5%yoy from 3.3%yoy in May was marginally lower than both ours and consensus estimates of 3.6%yoy.

• Non-food items, clothing/footwear & housing/utilities/fuel were the main inflationary drivers: Non-food items continued to exert inflationary pressure, up 3.0%yoy in June from 2.8%yoy in May. Further adding pressure on inflation are: (1) 0.3%yoy gain in clothing/footwear, after shrinking for three months in row with - 0.5%yoy in May; and (2) 1.9%yoy gain in housing/utilities/fuel from 1.8%yoy in May following the electricity tariff hike in June for the 1st

time in three years.

• We expect Malaysia inflation pressure to remain in 3Q2011. In our view, upward price pressure could emanate from food & non-alcoholic beverages as well as clothing/footwear in view of the festive seasons. We believe there could be some impact from June’s electricity tariff hike. The upward pressure can be contained from stronger RM/USD that will ease pressure from imported inflation as well as increasingly higher base comparison.

• Malaysia Inflation pressure to ease in late 3Q2011 or early 4Q2011: But looking further into 2H2011, we expect inflation to start tapering sometime late 3Q2011 or early 4Q2011. Apart from the high base effect, we believe stronger RM/USD, possible stabilization of global food and commodity prices as well as the impact from monetary tightening would ease some levels of price pressure. We are of the view that the authorities will not relax fuel subsidy or raise electricity tariff in 2H2011.

• Rate hike may have reach its tail end in AxJ: Current global uncertainties flared by euro debt crisis and slower US economic recovery raised eyebrows over the growth potential in Asia ex-Japan (AxJ) that includes Malaysia. We expect AxJ policymakers to increasingly lean towards growth as opposed to inflation, implying rate hikes could be reaching its tail end.

• Expect Bank Negara Malaysia (BNM) to accommodate further erosion in real returns in the near term: We believe BNM will take a short breather on its monetary tightening policy, implying they would be prepared to see further erosion of their real rate returns in the very near term by holding Overnight Policy Rate (OPR) at 3.00% and focusing on growth. We have seen such behavior in the past. Hence, we take the view that BNM would hold OPR at 3.00% with possibilities for another 25bps hike only if inflation becomes increasingly a nuisance.

• Possibilities for SRR to be raised will depend much on liquidity inflow: On the liquidity management, with SRR now at 4.00%, we are not ruling out the possibilities for further SRR hike in 2H2011. In our view, much will depend on the inflow of liquidity. If the inflow of funds remains strong, room for another 50bps to 100bps hike in SRR cannot be ruled out. However, if liquidity continues to stay strong, possibilities of introducing selective capital control to address inflow of funds could be unveiled.

by MIDF Research.