Parkson BUY RM5.55 KLCI : 1,470.93 Price Target : 12-Month RM 6.55 (Prev RM 7.45)

Reason for Report : Listing of PRA

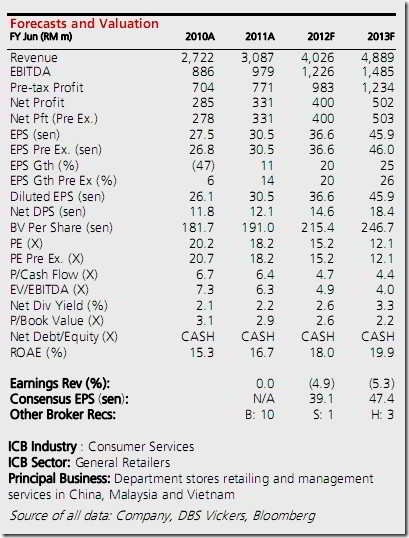

DBSV vs Consensus: Our estimates are below consensus as we believe consensus has not factored in 32.4% MI arising from PRA listing

PRA’s new pricing benchmark

• PRA listing at FY12F PE of 13x

• 5% earnings dilution to PHB

• Twin exposure to rising consumption growth story; maintain Buy with new TP of RM6.55

PRA’s IPO price set at S$0.94. Parkson Retail Asia Limited (PRA) is slated for listing on the Main Board of Singapore Exchange (SGX) on 3 Nov 2011. The IPO exercise will involve a total offering of 147m PRA shares comprising 80m new shares and 67m vendor shares (with an option to add 22m vendor shares for over-allotment purpose) from Parkson Holdings (PHB) and PT Mitra Samaya (MS) at S$0.94 per share. This will raise S$138m, which is lower than the initially speculated S$300m-500m possibly due to the prevailing market uncertainties. The IPO price values PRA at S$636m (or RM1.6b) based on an enlarged share base of 677m, implying 13x of S$48m earnings in FY12F.

5% earnings dilution to PHB. Post-listing of PRA, PHB’s stake will be diluted to 67.6% (from 90.1%) assuming the over-allotment option is exercised, prompting us to trim our FY12F-13F earnings by 4.9% and 5.3% respectively to account for the earnings leakage to minority interest (MI) and incremental interest income from the IPO proceeds of RM185m. We are maintaining our FY12F-13F net profit for PRA at S$48m (or RM117m) and S$61m (or RM150m) respectively. This translates to a 2-year CAGR of 28%, backed by healthy same store sales growth of 5-20% and 6 new stores addition p.a over the next 1-2 years.

PHB offers best of both worlds; Maintain Buy. We cut our PHB’s TP to RM6.55 (from RM7.45) after imputing: (i) PHB’s 51.5%-owned HK listed subsidiary Parkson Retail Group Ltd (PRG: 3368 HK)’s new TP of HK$11.46 (from HK$13.15); and (ii) reduced stake of 67.6% (from 90.1%) in PRA. We have also assumed a 15% holding company discount for both the listed subsidiaries, which is narrower than the 20% discount previously attached to PRG given PHB’s new corporate structure of having double exposures to two listed subsidiaries now. We keep our sum-of-part valuation of RM2.2b (RM3.25/share or S$1.33/share) for PRA, valuing it at 16.5x CY12F earnings. Our valuation implies a 41% upside potential to PRA’s IPO price of S$0.94. Based on current market capitalization of PHB and its share of PRG market capitalisation, PRA is currently valued at only RM0.37/share.

by HwangDBS Vickers Research