Blue chips on Bursa Malaysia slipped into profit-taking correction mode late last week, reversing earlier first-half window-dressing gains due to increased geopolitical concern over Iraq and downward revision to United States economic growth. Sentiment was adversely affected by comments from a US Federal Reserve official on the possibility of raising interest rates by the end of the first quarter of next year, as the US jobless rate may fall below six per cent and inflation is likely to rise back to two per cent later this year.

For the week, the FTSE Bursa Malaysia KLCI (FBM KLCI) slipped 4.79 points, or 0.25 per cent, to 1,880.93, with gas in Tenaga Nasional Bhd (+26 sen) and Sime Darby (+14 sen) overshadowed by losses in Public Bank Bhd (-64 sen), Genting Bhd (-18 sen) and Felda Global Ventures Holdings Bhd (-21 sen). Average daily traded volume and value last week was flat at 1.71 billion shares and RM2.01 billion, compared with the 1.72 billion shares and RM1.78 billion average

respectively, the previous week.

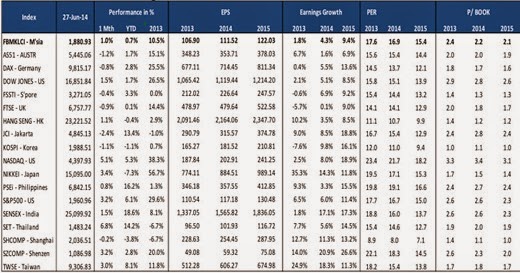

FBMKLCI Performance & Earnings Growth vs. Other Markets:

The benchmark index took the cue from Wall Street’s record high performance and hit a new high of 1,892.33 last week. The surge was supported by an appreciation in TNB’s share price after news about MyPower Corp’s recommendation to the government to stay on course on fuel cost pass-through mechanism (FCPT) and utilise savings from power purchase agreementto subsidise tariff hike stoked speculation on potential hike in electricity tariff.The tariff is supposed to be adjusted every 6 months, which means the revised tariff should come into effect tomorrow.

With crude oil pricon an uptrend since last November and above US$100 (RM320) a barrel in recent weeks, the government could be hard- pressed to pursue an electricity tariff hike in the end-June review to reduce subsidy burden. More so with prospects of it rising further cannot be discounted with the insurgence in Iraq spreading to the southern region and tensions in Ukraine.

Nonetheless, with the start of fasting period for Muslims yesterday and the Hari Raya Aidilfitri festival next month, a decision to raise the electricity tariff and even fuel prices now may be deemed as an untimely move. This could be followed by a 25 basis points hike in Overnight Policy Rate by Bank Negara Malaysia in its September meeting.

The power sector reform is positive for Tenaga and should contribute to further appreciation in its share price, which is still deemed undervalued vis-à-vis regional peers. Our base case scenario presently values the stock at RM13.96 based on CY15 PER of 15x, given the earnings volatility arising from fluctuation of fuels price. Assuming FCPT is implemented as planned, a key risk to earnings will diminish and will entice us to value stock on teh DFC basis. This will raise our value to RM15.70 (+12.5%).

The current underlying momentum points to further cost pressure to overall corporate earnings and raises doubts about the sustainability of the current uptrend in FBM KLCI due to its lofty valuation and unexciting single-digit earnings growth this year and next year vis-à-vis regional peers. The inflow of foreign funds since last April has absorbed selling from local institutional funds and contributed to the current uptrend. Nonetheless, the total outflow of slightly over RM2 billion year-to-date is small compared to net cumulative inflow of RM16.1 billion in the last two years. Any sharp reversal in foreign fund flows will have a dampening effect on the index.

With corporate earnings under pressure, it all depends on how well the central bank is going to manage interest rate hike expectations to prevent any sudden fund outflows, especially if there are indications of US intererates rising sooner-than-expected. In the interim period, ride the liquidity wave while it lasts

As for this week, anticipate the FBM KLCI to recover some lost ground today as a final touch to 1H14 window-dressing but mild corrections could ensue for the rest of the week in the absence of fresh catalyst. Historically, post-FIFA World Cup period and the third-quarter have not been favourable for our equity market. Eight of the 15 or 53.3% of the indices being tracked corrected in the 1-month period post World Cup. Average contraction in the indices during the last 9 World Cup events was -1.8%, which means most of the indices gave back their gains and were back to pre-World Cup levels. The probability of correction in FBMKLCI 1-nth post World Cup is 55.6% and the average historical correction was 3.5%. If we remove the outlier in 1998 due to Asian financial crisis, the fall was only 1.1%. So, anticipate some correction in the benchmark index befire it rebounds in the final quarter of the year.

by TA Securities